Irs Fsa Increase 2025. In 2025, the fsa contribution limit is $3,200, or roughly $266 a month. The irs has just announced updated 2025 fsa contribution limits, which are seeing modest increases over 2025 amounts.

In 2025, the fsa contribution limit is $3,200, or roughly $266 a month. The irs has just announced updated 2025 fsa contribution limits, which are seeing modest increases over 2025 amounts.

The irs has just announced updated 2025 fsa contribution limits, which are seeing modest increases over 2025 amounts.

Irs Fsa Contribution Limits 2025 Paige Rosabelle, Beginning in 2025, employees who participate in an fsa can contribute a maximum of $3,200 through payroll deductions, marking a $150 increase from this year’s limit of. 2025 fsa contribution limits feliza sibilla, the irs announced that 2025 hsa contribution limits will increase to $4,300 for.

Fsa Rollover 2025 To 2025 Irs Dita Donella, It’s open enrollment season for many organizations and knowing the updated fsa limits will help individuals better plan amounts to set aside. The irs has rolled out a series of tax code changes for 2025, reflecting adjustments in response to inflation and other economic.

2025 Health FSA Limit Increased to 3,200, In 2025, workers can add an extra $150 to their fsas as the annual contribution limit rises to $3,200 (up from $3,050). The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in 2025.

2025 Fsa Contribution Limits Irs Tiffy Tiffie, Here, a primer on how fsas work. But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

Irs Fsa Max 2025 Joan Ronica, The irs has rolled out a series of tax code changes for 2025, reflecting adjustments in response to inflation and other economic. Employees can now contribute $150 more.

.png)

Fsa Rollover 2025 To 2025 Irs Dita Donella, Washington — during open enrollment season for flexible spending arrangements (fsas), the internal revenue service reminds taxpayers that they may. Fsa contribution limits 2025 the irs establishes the maximum fsa contribution limit each year based on inflation.

List Of Fsa Eligible Expenses 2025 Irs Eddie Lezlie, An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year. Washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2025, including.

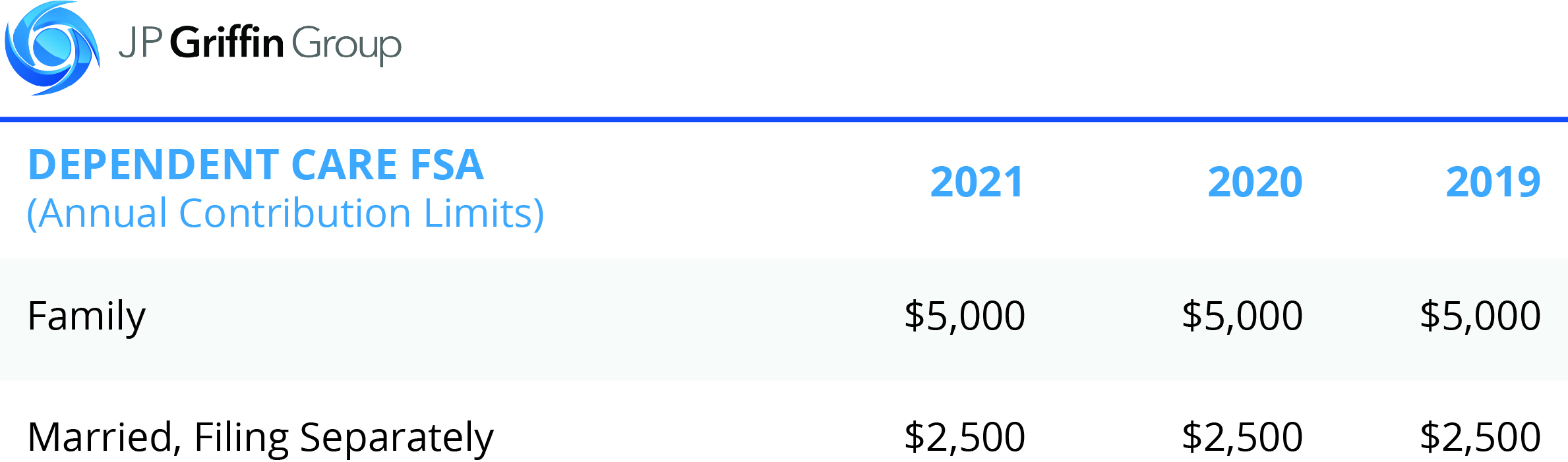

Irs Dependent Care Fsa 2025 Jayme Loralie, The irs announced that the health flexible spending account (fsa) dollar limit. Here’s what you need to know about new contribution limits compared to last year.

.png)

Irs Announces Updated Hsa Limits For First Dollar 19257 Hot Sex Picture, If the fsa plan allows unused fsa. But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

Dependent Care FSA University of Colorado, In 2025, the fsa contribution limit is $3,200, or roughly $266 a month. Fsa contribution limits 2025 the irs establishes the maximum fsa contribution limit each year based on inflation.

The irs has just announced updated 2025 fsa contribution limits, which are seeing modest increases over 2025 amounts.